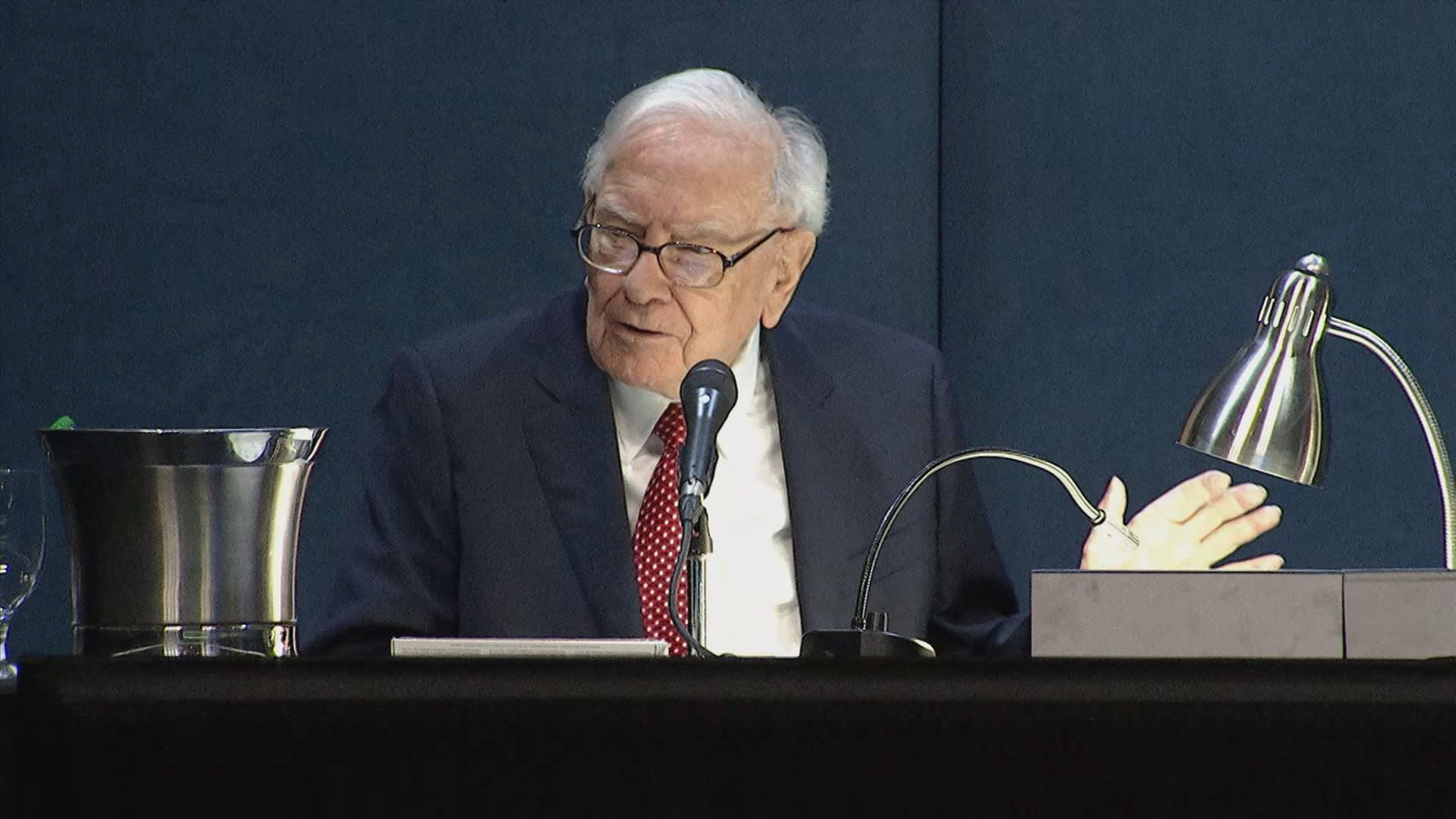

Warren Buffett surprised many investors by downsizing one of his longest held and largest positions — Bank of America . Here’s what could have driven the sale by the Oracle of Omaha. Berkshire Hathaway recently unloaded 52.8 million Bank of America shares worth $2.3 billion during a six-day selling spree, the first time since late 2019 that the Omaha-based conglomerate reduced its holding. Berkshire still owns 980.1 million BofA shares with a market value of $41.3 billion , a distant second to its $172.5 billion holding in Apple . Buffett famously bought $5 billion worth of BofA’s preferred stock and warrants in 2011 in the aftermath of the financial crisis, shoring up confidence in the embattled lender struggling with losses tied to subprime mortgages. He converted those warrants in 2017, making Berkshire the largest shareholder in BofA, vowing that it would be a “long, long time” before he would sell. The legendary investor said then that he liked the business, valuation and management of the Charlotte-based bank “very much.” BofA, under the leadership of Brian Moynihan since 2010, just reported blowout results that showed rising investment banking and asset management fees as well as a positive outlook on net interest income. One red flag that’s recently stuck out is valuation. BofA is currently trading for about 12 times forward earnings, compared to an average multiple of 10 times over the past two years, according to FactSet. The bank stock has rallied 24% this year, outperforming the S & P 500’s near 15% return. So Berkshire could be taking some profits after BofA’s advance to its highest levels since March 2022. Berkshire’s cost basis on the BofA position was about $14.15 per share or $14.6 billion as disclosed at the end of 2021, according to Berkshire analyst James Shanahan at Edward Jones. At the end of March, the holding was worth $39.2 billion. BofA closed Friday at $41.67. BAC YTD mountain Bank of America Tax liability Taxes could also be a motivating factor in the BofA sale. Buffett sold a slice of his gigantic Apple stake in the first quarter, indicating that the sale could be a means of avoiding an even higher tax bill down the road if corporate tax rates rise. “It doesn’t bother me in the least to write that check, and I would really hope with all that America’s done for all of you, it shouldn’t bother you that we do it. And if I’m doing it at 21% this year, and we’re doing it [at] a little higher percentage later on, I don’t think you’ll actually mind the fact that we sold a little Apple this year,” Buffett said at Berkshire’s annual meeting in early May. As a corporation, any income generated by Berkshire, whether it’s from a wholly-owned business, such as Dairy Queen, or an equity investment, such as Apple, has been taxed at a flat 21% federal corporate rate since 2018. Buffett, who paid over $5 billion in corporate taxes in 2023, believes the corporate tax rate could move higher to help fill the government’s yawning gap between spending and revenue. Buffett’s quirk Buffett’s Bank of America investment has long been one of the most quirky and endearing Wall Street stories as he revealed that it came to him as a bathtub epiphany. “Incidentally, that BofA purchase, it literally was true that I was sitting in the bathtub when I got the idea of checking with … BofA, whether they’d be interested in that preferred,” he said at Berkshire’s annual meeting in 2017. To add to the story’s charm, Moynihan, the BofA CEO, recalled that Buffett initially tried to reach him through the bank’s public call center, only to be booted off the call by a service representative. That didn’t stop Buffett, though. The deal came together within hours once the two finally connected, Moynihan said.