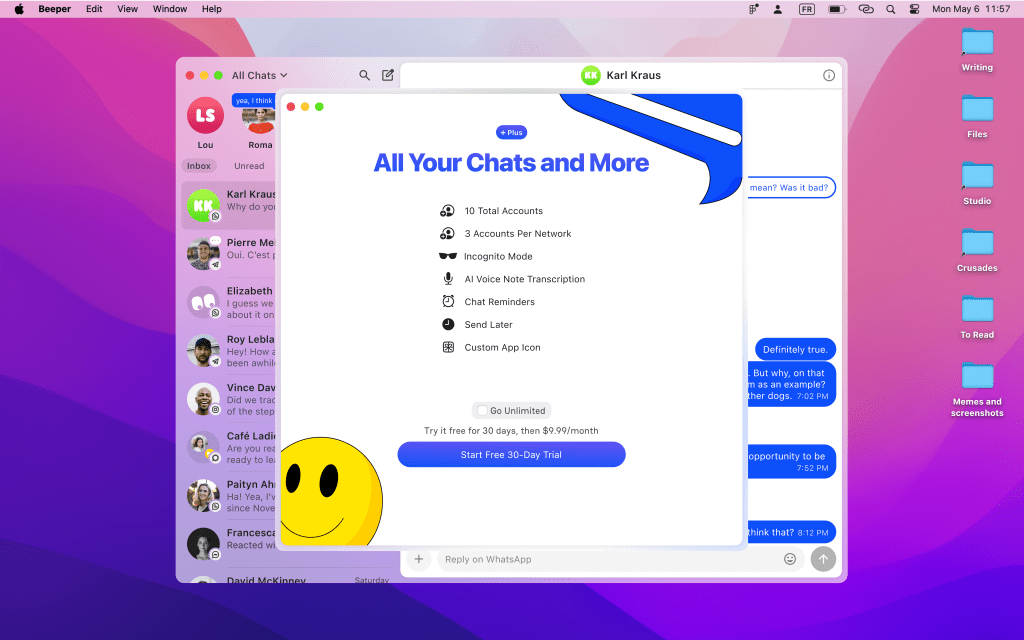

A recent paper from the Bitcoin Policy Institute titled The Case for Bitcoin as a Reserve Asset argued that central banks should adopt Bitcoin (BTC) as a reserve asset to hedge against rising inflation, geopolitical risks, capital control risks, sovereign default, bank failures, and international sanctions imposed by the United States government.

Economist Matthew Ferranti, the paper’s author, made the case that Bitcoin is an “Effective portfolio diversifier” due to a weak correlation between the decentralized asset and other financial instruments.

The economist also highlighted Bitcoin’s lack of counter-party risk as an effective hedge against sovereign defaults — including the risk of financial sanctions — which Ferranti labeled as a form of “Selective default” impacting nations like Venezuela and Russia.

Ferranti clarified that Bitcoin and gold allocations might not be the answer for every central bank; however, the nascent digital asset serves the same store-of-value and hedging properties as gold — particularly against rapid currency depreciation.

Correlations between Bitcoin and other reserve assets. Source: Bitcoin Policy Institute.

Related: Bitcoin Amsterdam: Flawed research drives harmful Bitcoin policies

United States politicians push for Bitcoin Strategic Reserve

The Bitcoin Policy Institute’s paper echoed calls from Presidential candidates and US lawmakers to establish Bitcoin as a strategic reserve asset of the United States Treasury Department.

Following former President Trump’s keynote address at the Bitcoin 2024 conference in Nashville, Tennessee, Wyoming Senator Cynthia Lummis introduced the Bitcoin Strategic Reserve Bill in the US Senate. The bill sets the ambitious goal of acquiring 5% of Bitcoin’s total supply over time.

In an interview with Maria Bartiromo of Fox News, Trump hinted at paying the national debt with Bitcoin — a nod to the supply-capped asset’s power to absorb and transmute currency inflation into economic prosperity.

Current US national debt breakdown. Source: US Debt Clock.

Microstrategy CEO and Bitcoin thought leader Michael Saylor praised the Bitcoin strategic reserve initiative as the 21st-century equivalent of the Louisiana Purchase. For context, former US President and founding father Thomas Jefferson purchased the Louisiana territories from France for $15 million in 1803 — doubling the geographic area of the United States at the time.

Despite the popularity of the strategic reserve idea among Bitcoin holders, not everyone is on board with the effort. Cardano founder Charles Hoskinson previously argued that while the adoption of BTC as a strategic reserve asset would boost the price of Bitcoin, it would also allow state actors to influence the Bitcoin network.

Magazine: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer, X Hall of Flame

Trump Media and Technology Group (TMTG), majority-owned by US President Donald Trump’s family, has filed for two artificial intelligence (AI) trademarks tied to a planned feature on the Truth Social… Mary-Catherine Lader, president and chief operating officer of Uniswap Labs, has reportedly resigned after four years with the company. According to a Bloomberg report on Tuesday, Lader will stay in…Trump Media Files AI Trademarks to Expand Truth Social

Uniswap President Steps Down to Pursue New Ventures