TABLE OF CONTENTS

1. Why ETFs?

When constructing a portfolio, Betterment focuses on exchange traded funds (“ETFs”) securities with generally low-costs and high liquidity. An ETF is a security that generally tracks a broad-market stock or bond index or a basket of assets just like an index mutual fund, but trades just like a stock on a listed exchange. By design, index ETFs closely track their benchmarks—such as the S&P 500 or the Dow Jones Industrial Average—and are bought and sold like stocks throughout the day. ETFs have certain structural advantages when compared to mutual funds. These include:

A. Clear Goals and Mandates

Betterment generally selects ETFs that have mandates to passively track broad-market benchmark indexes. A passive mandate explicitly restricts the fund administrator to the singular goal of replicating a benchmark rather than making active investment decisions constituting market timing, building concentration in either a single name, group of names, or themes in an effort to beat the fund’s underlying benchmark. Adherence to this mandate ensures the same level of investment diversification as the benchmark indexes, makes performance more predictable, and reduces idiosyncratic risk associated with active manager decisions.

B. Intraday Availability

ETFs are transactable during all open market hours just like any other stock. As such, they are heavily traded by the full spectrum of equity market participants including market makers, short-term traders, buy-and-hold investors, and fund administrators themselves creating and redeeming units as needed (or increasing or decreasing the supply of ETFs based on market demand).

This diverse trading activity leads to most ETFs carrying low liquidity premiums (or lower costs to transact due to competition from readily available market participants pushing prices downward) and equity-like transaction times irrespective of the underlying holdings of each fund. This generally makes ETFs fairly liquid, which makes them cheaper and easier to trade on-demand for activities like creating a new portfolio or rebalancing an existing one.

C. Low Fee Structures

Because most benchmarks update constituents (i.e., the specific stocks and related weights that make up a broad-market index) fairly infrequently, passive index-tracking ETFs also register lower annual turnover (or the rate a fund tends to transact its holdings) and thus fewer associated costs are passed through to investors.

In addition, ETFs are generally managed by their administrators as a single share class that holds all assets as a single entity. This structure naturally lends itself as a defense against administrators practicing fee discrimination across the spectrum of available investors.

With only one share class, ETFs are investor-type agnostic. The result is that ETF administrators provide the same exposures and low fees to the entire spectrum of potential buyers.

D. Tax Efficiency

In the case when a fund (irrespective of its specific structure) sells holdings that have experienced capital appreciation, the capital gains generated from those sales must, by law, be accrued and distributed to shareholders by year-end in the form of distributions. These distributions increase tax liabilities for all of the fund’s shareholders. With respect to these distributions, ETFs offer a significant tax advantage for shareholders over mutual funds.

Because mutual funds are not exchange traded, the only available counterparty available for a buyer or seller is the fund administrator. When a shareholder in a mutual fund wishes to liquidate their holdings in the fund, the fund’s administrator must sell securities in order to generate the cash required to satisfy the redemption request. These redemption-driven sales generate capital gains that lead to distributions for not just the redeeming investor, but all shareholders in the fund. Mutual funds thus effectively socialize the fund’s tax liability to all shareholders, leading to passive, long-term investors having to help pay a tax bill for all intermediate (and potentially short-term) shareholder transactions.

Because ETFs are exchange traded, the entire market serves as potential counterparties to a buyer or seller. When a shareholder in an ETF wishes to liquidate their holdings in the fund, they simply sell their shares to another investor just like that of a single company’s equity shares. The resulting transaction would only generate a capital gain or loss for the seller and not all investors in the fund.

In addition, ETFs enjoy a slight advantage when it comes to taxation on dividends paid out to investors. After the passing of the Jobs and Growth Tax Relief Reconciliation Act of 2003, certain qualified dividend payments from corporations to investors are only subject to the lower long-term capital gains tax rather than standard income tax (which is still in force for ordinary, non-qualified dividends). Qualified dividends have to be paid by a domestic corporation (or foreign corporation listed on a domestic stock exchange) and must be held by both the investor and the fund for 61 of the 120 days surrounding the dividend payout date. As a result of active mutual funds’ higher turnover, a higher percentage of dividends paid out to their investors violate the holding period requirement and increase investor tax profiles.

E. Investment Flexibility

The maturation and growth of the global ETF market over the past few decades has led to the development of an immense spectrum of products covering different asset classes, markets, styles, and geographies. The result is a robust market of potential portfolio components which are versatile, extremely liquid, and easily substitutable.

Despite all the advantages of ETFs, it is still important to note that not all ETFs are exactly alike or equally beneficial to an investor. Betterment’s investment selection process seeks to select ETFs that provide exposure to the desired asset classes with the least amount of difference between underlying asset class behavior and portfolio performance. In other words, we attempt to minimize the “frictions” (the collection of systematic and idiosyncratic factors that lead to performance deviations) between ETFs and their benchmarks.

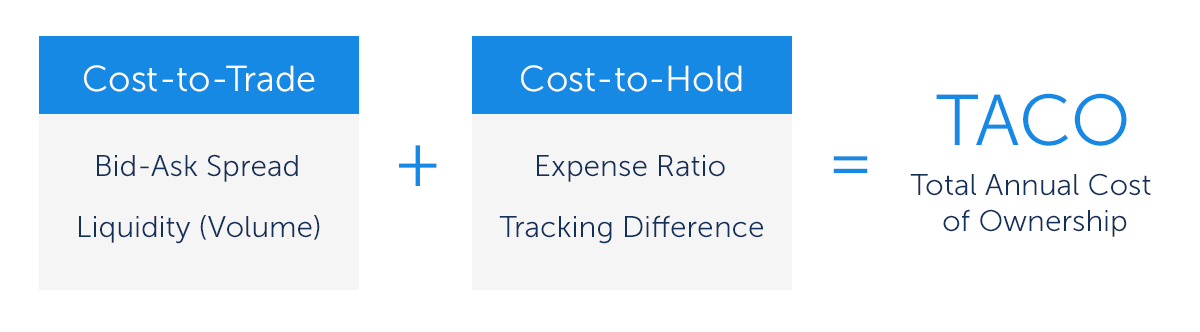

Betterment’s measure of these frictions is summarized as the “total annual cost of ownership”, or TACO: a composition of all relevant frictions used to rank and select ETF candidates for the Betterment portfolio.

2. Total Annual Cost of Ownership (TACO)

The total annual cost of ownership (TACO) is Betterment’s fund scoring method, used to rate funds for inclusion in the Betterment portfolio. TACO takes into account an ETF’s transactional and liquidity costs as well as costs associated with holding funds. In addition to TACO, Betterment also considers certain other qualitative factors of ETFs, including but not limited to, whether the ETF fulfills a desired portfolio mandate and/or exposure.

TACO is determined by two components, a fund’s cost-to-trade and cost-to-hold.

The first, cost-to-trade, represents the cost associated with trading in and out of funds during the course of regular investing activities, such as rebalancing, cash inflows or withdrawals, and tax loss harvesting.

Cost-to-trade is generally influenced by two factors:

- Volume: A measure of how many shares change hands each day.

- Bid-ask spread: The difference between the price at which you can buy a security and the price at which you can sell the same security at any given time.

The second component, cost-to-hold, represents the annual costs associated with owning the fund and is generally influenced by these two factors:

- Expense ratios: Fund expenses imposed by an ETF administrator.

- Tracking difference: The deviation in performance from the fund’s benchmark index.

Let’s review the specific inputs to each component in more detail:

Cost-to-Trade: Volume and Bid-Ask Spread

Volume: Volume is a historical measure of how many shares may change hands each day. This helps assess how easy it might be to find a buyer or seller in the future. This is important because it tends to indicate the availability of counterparties to buy (e.g., when Betterment is selling ETFs) and sell (e.g., when Betterment is buying ETFs). The more shares of an ETF Betterment needs to buy on behalf of our client, the more volume is needed to complete the trades without impacting market prices. As such, we measure average market volume for each ETF as a percentage of Betterment’s normal trading activity. Funds with low average daily trading volume compared to Betterment’s trading volume will have a higher cost, because Betterment’s higher trading volume is more likely to influence market prices.

Bid-Ask Spread: Generally market transactions are associated with two prices: the price at which people are willing to sell a security, and the price others are willing to pay to buy it. The difference between these two numbers is known as the bid-ask spread, and can be expressed in currency or percentage terms.

For example, a trader may be happy to sell a share at $100.02, but only wishes to buy it at $99.98. The bid-ask currency spread here is $.04, which coincidentally also represents a bid-ask percentage of 0.04%. In this example, if you were to buy a share, and immediately sell it, you’d end up with 0.04% less due to the spread. This is how traders and market makers make money—by providing liquid access to markets for small margins.

Generally, heavily traded securities with more competitive counterparties willing to transact will carry lower bid-ask spreads. Unlike the expense ratio, the degree to which you care about bid-ask spread likely depends on how actively you trade. Buy-and-hold investors typically care about it less compared to active traders, because they will accrue significantly fewer transactions over their intended investment horizons. Minimizing these costs is beneficial to building an efficient portfolio which is why Betterment attempts to select ETFs with narrower bid-ask spreads.

Cost-to-Hold: Expense Ratio and Tracking Difference

Expense Ratio: An expense ratio is the set percentage of the price of a single share paid by shareholders to the fund administrators every year. ETFs often collect these fees from the dividends passed through from the underlying assets to holders of the security, which result in lower total returns to shareholders.

Tracking Difference: Tracking difference is the underperformance or outperformance of a fund relative to the benchmark index it seeks to track. Funds may deviate from their benchmark indexes for a number of reasons, including any trades with respect to the fund’s holdings, deviations in weights between fund holdings and the benchmark index, and rebates from securities lending. It’s important to note that, over any given period, tracking difference isn’t necessarily negative; in some periods, it could lead to outperformance. However, tracking difference can introduce systematic deviation in the long-term returns of the overall portfolio when compared purely with a comparable basket of benchmark indexes other than ETFs.

Finding TACO

We calculate TACO as the sum of the above components:

TACO = “Cost-to-Trade” + “Cost-to-Hold”

As mentioned above, cost-to-trade estimates the costs associated with buying and selling funds in the open market. This amount is weighted to appropriately represent the aggregate investing activities of the average Betterment client in terms of cash flows, rebalances, and tax loss harvests.

The cost-to-hold represents our expectations of the annual costs an investor will incur from owning a fund. Expense ratio makes up the majority of this cost, as it is the most explicit and often the largest cost associated with holding a fund. We also account for tracking difference between the fund and its benchmark index.

In many cases, cost-to-hold, which includes an ETF’s expense ratio, will be the dominant factor in the total cost calculations. Of course, one can’t hold a security without first purchasing it, so we must also account for transaction costs, which we accomplish with our cost-to-trade component.

3. Minimizing Market Impact

Market impact, or the change in price caused by an investor buying or selling a fund, is incorporated into Betterment’s total cost number through the cost-to-trade component. This is specifically through the interaction of bid-ask spreads and volume. However, we take additional considerations to control for market impact when evaluating our universe of investable funds.

A key factor in Betterment’s decision-making is whether the ETF has relatively high levels of existing assets under management and average daily traded volumes. This helps to ensure that Betterment’s trading activity and holdings will not dominate the security’s natural market efficiency, which could either drive the price of the ETF up or down when trading.

We define market impact for any given investment vehicle as the Betterment platform’s relative size (RSRS) in two key areas.

Our share of the fund’s assets under managements is calculated quite simply as

RS of AUM = (‘AUM of Betterment”https://www.betterment.com/”AUM of ETF’)

while our share of the fund’s daily traded volume is calculated as

RS Vol = (‘Vol of Betterment”https://www.betterment.com/”Vol of ETF’)

ETFs without an appropriate level of assets or daily trade volume might lead to a situation where Betterment’s activity on behalf of clients moves the existing market for the security. In an attempt to avoid potentially negative effects upon our investors, we generally do not consider ETFs with smaller asset bases and limited trading activity unless some other extenuating factor is present.

Conclusion

As with any investment, ETFs are subject to market risk, including the possible loss of principal. The value of any portfolio will fluctuate with the value of the underlying securities. ETFs may trade for less than their net asset value (NAV). There is always a risk that an ETF will not meet its stated objective on any given trading day. Betterment reviews its asset selection analysis on a periodic basis to assess: the validity of existing selections, potential changes by fund administrators (raising or lowering expense ratios), and changes in specific ETF market factors (including tighter bid-ask spreads, lower tracking differences, growing asset bases, or reduced selection-driven market impact). Betterment also considers the tax implications of portfolio selection changes and estimates the net benefit of transitioning between investment vehicles for our clients.

We use the ETFs that result from this process in our allocation advice that is based on your investment horizon, balance, and goal. For the details on our allocation advice, please see Betterment’s Goal Allocation Recommendation Methodology.