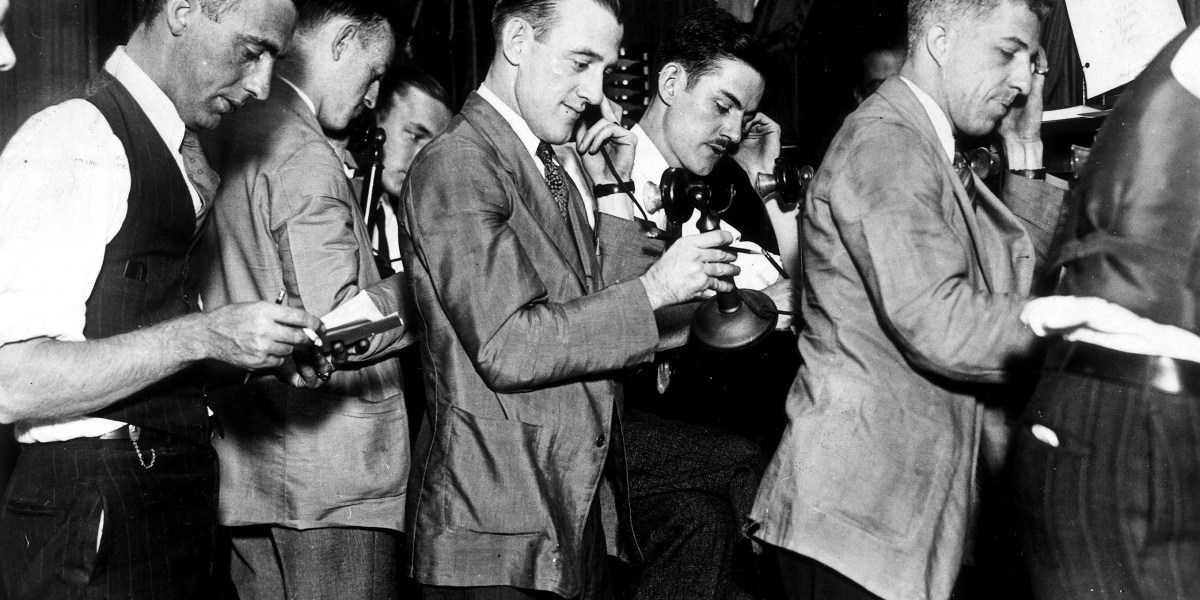

Since the U.S. economy began rebounding from the pandemic, market veteran Ed Yardeni has been banging the drum that a new “Roaring 20s” will drive Wall Street.

Now, with Donald Trump headed back to the White House, Republicans retaking the Senate, and the House likely staying in GOP control, a decade of bullish returns not only looks more probable, it could have longer legs.

“Indeed, it increases the odds that the good times will continue through the end of the decade and possibly into the 2030s,” Yardeni, the president of Yardeni Research, wrote in a note on Wednesday.

This decade is already off to a strong start. Except for a down year in 2022, when the Federal Reserve began an aggressive rate-hiking cycle, the S&P 500 has notched double-digit returns each year and is already up nearly 26% so far in 2024.

That comes after markets had their best week in a year, soaring after Trump’s decisive win with a Republican sweep looking likely. For the week, the S&P 500 finished up 4.7%, the Dow Jones Industrial Average gained 4.6%, the Nasdaq jumped 5.7%, and the small-cap Russell 2000 soared 8.6% as investors bet on lower taxes and deregulation juicing the economy further.

“We’re sticking with our investment recommendation to Stay Home rather than to Go Global,” Yardeni wrote. “In other words, overweight the US in global stock portfolios.”

Of course, the Roaring 20s from a century ago infamously ended with the stock market crash in 1929, which sparked the Great Depression that lasted through the 1930s.

And for his part, Yardeni sees other scenarios this century. But his view for a new Roaring 20s is the most likely with 50% odds, while a 1990s-style stock market “meltup” has 20% odds, and a 1970s-style geopolitical crisis with a possible US debt crisis has a 30% probability.

“But we are considering raising the odds of the Roaring 2020s scenario as a looser regulatory environment and lower corporate and income taxes under Trump 2.0 should boost investment and propel productivity-led economic growth,” he added.

Yardeni has also been warning about “bond vigilantes” sending yields higher as the outlook for U.S. debt and deficits continues to deteriorate. Trump’s tax cuts and tariffs are also seen as inflationary, limiting the Fed’s ability to cut rates further.

But Scott Bessent, who has been floated as a possible Treasury secretary under Trump, has noted that lower energy prices and deregulation are disinflationary and could offset the potential inflationary effects of higher tariffs.

“We sympathize with that view, but would also add productivity growth to the mix,” Yardeni said. “A tight labor market plus continued investment in new technologies like AI, robotics, and automation will help keep a lid on unit labor costs and therefore inflation.”

Others on Wall Street have also highlighted potential for another Roaring 20s, including analysts at UBS who said before the election that the likelihood of a booming economic cycle was 50%.

But Dan Ivascyn, chief investment officer at bond giant PIMCO, was more cautious about the effects of Trump’s policies on the economy and financial markets.

He told the Financial Times on Friday that the economy risks “overheating” under a second Trump administration, threatening Fed rate cuts and the stock market.

“It’s not as simple and easy as just a one-way reflationary trade where risk assets should rejoice,” Ivascyn told the FT. “You want to be a little careful about what you wish for.”

A newsletter for the boldest, brightest leaders:

CEO Daily is your weekday morning dossier on the news, trends, and chatter business leaders need to know.

Sign up here.