Market moves:

- WTI crude oil down $1.20 to $67.10

- US 10-year yields down 2.9 bps to 4.15%

- Bitcoin up $2544 to $101,540

- Gold up $1 to $2633

- S&P 500 up 0.2%

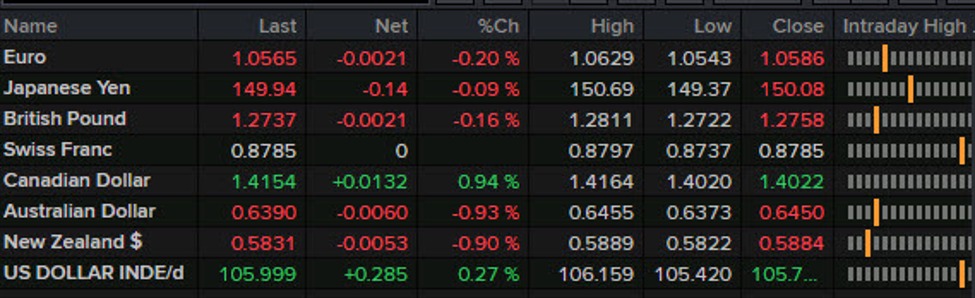

- JPY leads, AUD lags

The theme all week is that it’s been tough to tie market moves to economic news/data and today was no exception. The jobs report was dovish at the margin and that was backed up by Dec cut odds rising to 85% from 70% along with a 5 bps decline in 2-year yields. Initially the dollar slumped, which is what you would expect; USD/JPY fell to 149.50 from 150.50 and EUR/SUD rose to 1.0625 from 1.585 and there were similar moves elsewhere.

However about an hour after the release, the moves in FX began to retrace (while the moves in bonds didn’t) and the euro move was erased completely while the yen move was halved. Some might point to the UMich data or comments from Bowman but that’s a stretch.

Some of it could be flows into USD-denominated assets like megacap tech, which hit new highs but that’s a stretch. I struggle to offer any other insight aside from a reiteration that the US dollar remains the cleanest dirty shirt going into 2025.

The dirtier shirts on the day were the commodity currencies, and that’s not a good look for global growth. The Canadian dollar had a good excuse as everything below the surface of the jobs report was soft, including unemployment rising to the highest since 2016. It’s clear that high rates are biting and 50 bps next week is necessary, with the market now pricing it at 83%. The loonie is close to the four-year low set in November and will post the lowest weekly close since 2020.

What was less expected was the poor performance of the Australian and New Zealand dollars on Friday as they matched the loonie’s weakness tick-for-tick. There could be a sympathy trade at work but today’s weakness comes after a +1% gain in Chinese equities on optimism about stimulus at next week’s Work Conference, copper prices have also improved.

In any case, both AUD and NZD are near the lows of the year and with the RBA up first on Nov 10 (no cut expected) that’s worth watching.

Have a great weekend.