Former Prime Minister of Thailand Thaksin Shinawatra recently gave a lecture to an audience gathered at the Intercontinental Hotel in Hua Hin, in which he urged the government of Thailand to study cryptocurrencies and continue sandbox experimentation to remain relevant on the global stage.

According to an article from Money and Banking Online, the former Prime Minister did not suggest that Thailand should begin buying cryptocurrencies but urged Thailand to study digital assets because of the current global trend toward digitization. In a translated statement, the former PM said:

“There are already many cryptocurrencies. Some people say that in the future, we will have more currencies than countries. Today, Thai people must think and understand this.”

Shinawarta added that the looming threat of the incoming Trump administration’s trade tariffs and Trump’s idea of paying off the national debt with Bitcoin (BTC) were further reasons to explore and understand the digital economy.

The number of categories alone for digital assets has now surpassed the total number of countries. Source: CoinMarketCap

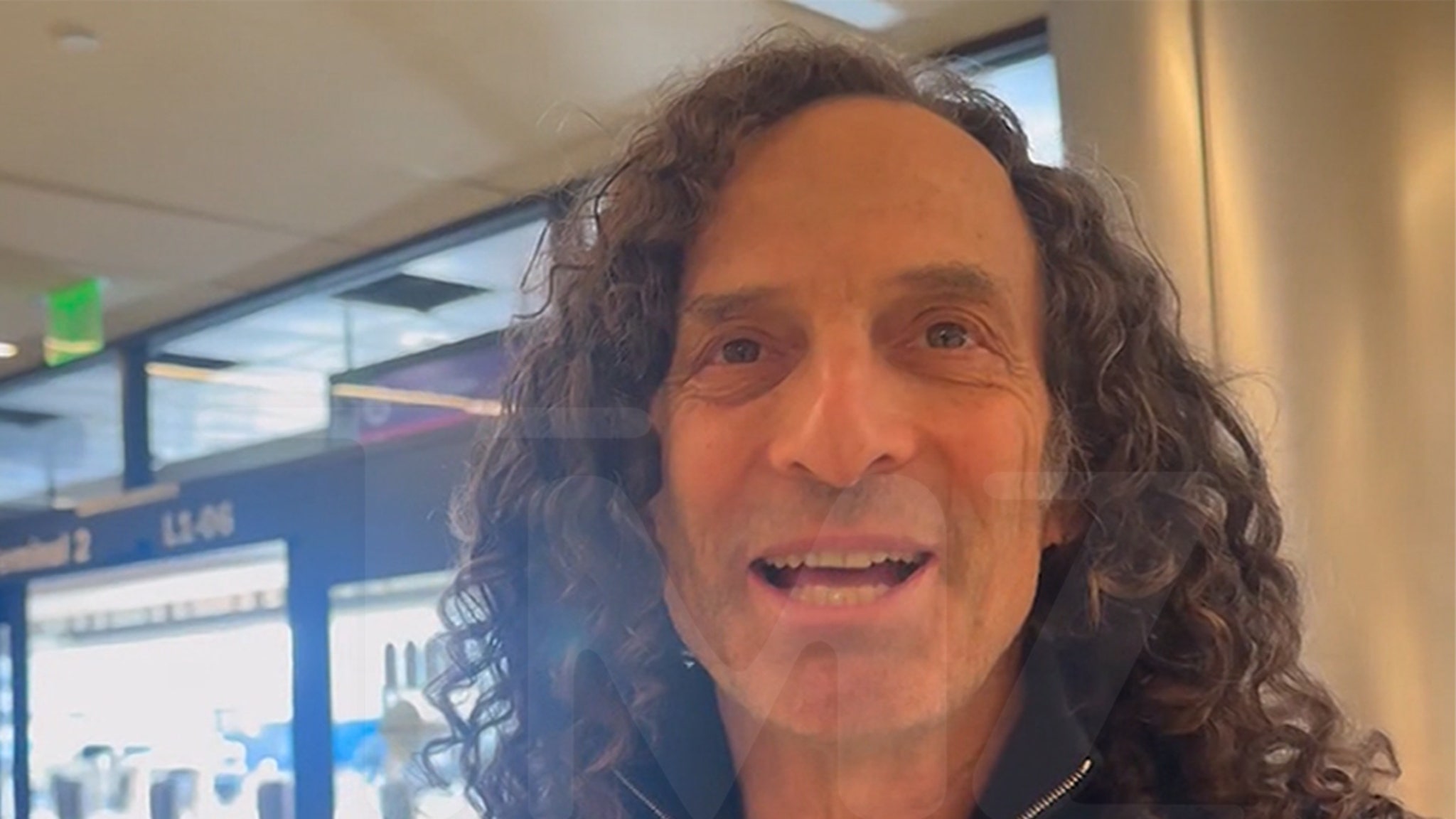

Related: Changpeng Zhao says it’s ‘inevitable’ for China to build a BTC reserve

Thailand experiments with the digital economy

In August 2024, Thailand’s Securities and Exchange Commission (SEC) announced a crypto regulatory sandbox for select service providers to experiment with digital assets.

Regulatory sandboxes provide businesses with a relaxed regulatory environment to experiment with nascent financial technologies, without fear of legal repercussions from state regulators.

The Pheu Thai political party followed through with campaign promises to distribute digital cash to 45 million residents of Thailand in July 2024 as a way to provide economic stimulus. Those who qualified for the party’s program received 10,000 baht, equivalent to roughly $280.

Kasikornbank, Thailand’s second-largest bank, became the country’s first licensed crypto custodian in Sept. 2024. The custodial services were geared toward digital asset businesses.

Thailand’s SEC also submitted a proposal on Oct. 9, to allow mutual and private funds access to crypto investments. The proposal is shifting the Thailand crypto market toward institutional crypto adoption, according to Binance Thailand’s CEO Nirun Fuwattananukul.

In October 2024, the Bank of Thailand partnered with the Hong Kong Monetary Authority (HKMA) to test tokenized cross-border settlements as part of the HKMA’s Project Ensemble.

Magazine: Thailand’s crypto islands: Working in paradise, Part 1