Rejoice! Another Tax Day has come and gone.

But don’t go shredding your receipts in celebration just yet. Now’s a good time to reflect and plant the seeds for a smoother tax season next year.

Because whether you overpaid and received a refund (roughly two-thirds of Americans do) or underpaid and had to cut a painful check, you can take a few actions now that have the potential to pay off down the road.

For the purpose of this article, we’ll divvy up these tips into three buckets:

- A tip for over-payers: Ignore the internet

- A tip for under-payers: Dial in your withholding

- A tip for all taxpayers: Save more to save more in taxes

A tip for over-payers: Ignore the internet

The internet commentariat will snidely tell you that getting a tax refund is like giving the government an interest-free loan. The implication being, you should stop doing it.

And of course, if your tax refund is pushing five figures, maybe you’d be better off putting some of that cash in your pocket (or the market) earlier in the year.

But the average tax refund typically falls in the ballpark of $3,000-$4,000. And we’ll be the first to tell you that in many cases, there’s little wrong with overpaying by that amount. Cash windfalls such as these can supercharge your savings goals.

There’s also an emotional benefit to “found” money. Even if that money was yours all along.

And the alternative of underpaying can sometimes have pricey consequences.

A tip for under-payers: Dial in your withholding

Most salaried workers have income taxes withheld from their paychecks throughout the year. Case closed, right? Not always.

Come tax time, some realize they still owe a substantial amount of taxes, so much so that the IRS slaps them with an underpayment penalty on top of their already nausea-inducing tax bill.

It happens more than you think. The IRS dished out more than $1.8 billion of these underpayment penalties to about 12 million people in 2022 alone.

If you’re one of these unfortunate souls, you have our sympathies. Now here’s our two-step tip:

Step 1: Increase the amount of income tax withheld from your paycheck by completing a fresh W-4 form and submitting it to your employer.

Step 2: As a backup plan, consider opening a new Cash Reserve account and setting up recurring deposits—just in case your withholding estimate was off and you still owe taxes next year.

How much cash should you set aside? One approach is to shoot for 10% of your total tax amount from this most recent return. You can find this amount on line 24 of your Form 1040.

A tip for all taxpayers: Save more to save more on taxes

One surefire way to make tax time less painful is to pay less taxes in the first place.

Sure, you could accomplish this by moving to one of the nine states with no income tax, but have you seen those Zestimates® lately? We’ll go ahead and unheart that idea for you.

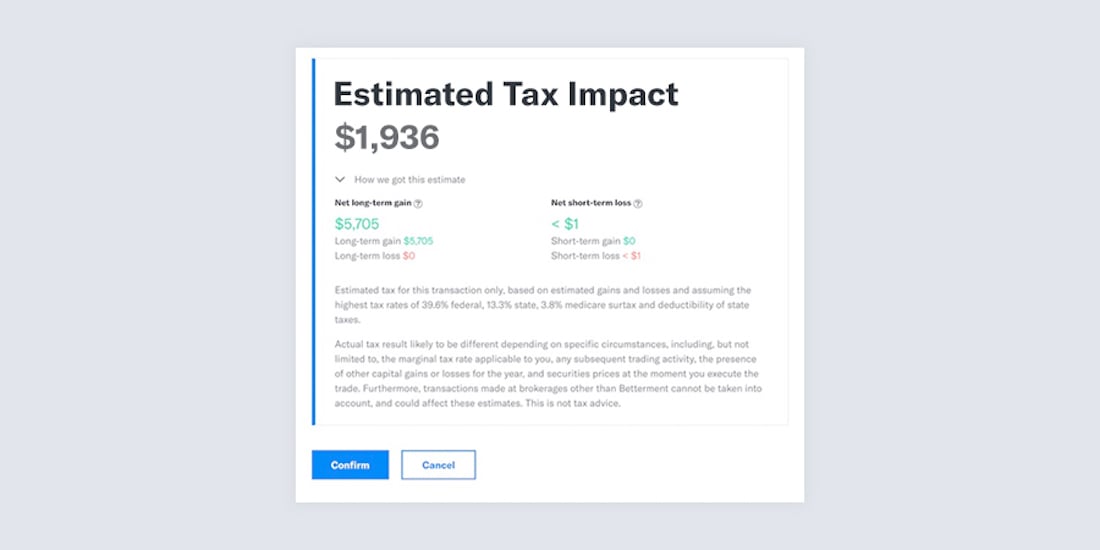

By comparison, an easier way to lighten your tax load is by contributing more to a traditional IRA and/or traditional 401(k). Between those two accounts, eligible individuals can reduce their taxable income by up to $30,000 in 2024. For someone making $77,000, the point at which the IRS starts to phase out a traditional IRA’s tax benefits, that could mean more than $5,000 in federal tax savings.

And it all comes with the sweet, sweet side effect of saving more for retirement.