Cryptocurrency exchange Coinbase won a small victory in its civil case against the US Securities and Exchange Commission (SEC) after a federal judge granted an order for an interlocutory appeal.

In a Jan. 7 filing in the US District Court for the Southern District of New York, Judge Katherine Failla granted an appeal for an order denying Coinbase’s motion for judgment, which she filed in March 2024. Judge Failla ordered all proceedings in the case to be stayed until the Second Circuit ruled on an interlocutory appeal over the order.

One of the crucial arguments for the SEC’s case against Coinbase was alleging that “certain transactions involving crypto-assets qualified as investment contracts within the SEC’s regulatory purview,” i.e., as securities. Judge Failla said there was a “possibility of reversal” of her interpretation of investment contracts based on the Howey test, granting Coinbase’s appeal.

Jan. 7 order granting Coinbase’s interlocutory appeal. Source: Courtlistener

The filing noted “conflicting conclusions” from judges overseeing the SEC’s civil cases against Terraform Labs and Ripple Labs. Each court decision had varying interpretations of what constituted a security, including a judge in the Ripple case ruling that the XRP token was not a security in regard to programmatic sales on crypto exchanges.

“Although the Court does not appreciate, and will not co-sign, Coinbase’s efforts to cast aspersions on the SEC’s approach to crypto-assets […] the fact remains that these conflicting decisions on an important legal issue necessitate the Second Circuit’s guidance,” said Judge Failla.

The SEC filed the enforcement action against Coinbase in June 2023, alleging that the exchange had operated as an unregistered securities exchange, broker, and clearing agency “since at least 2019.” Many in the crypto industry have criticized the SEC and Chair Gary Gensler specifically for overreaching its authority with civil actions.

Related: US crypto execs express hope for regulatory clarity in 2025

Coinbase chief legal officer Paul Grewal said in a Jan. 7 X post that the company “appreciate[d] the Court’s careful consideration” in granting the appeal. The exchange has also been backing efforts to have government agencies release documents suggesting that officials orchestrated a campaign to debank crypto firms — colloquially called Operation Chokepoint 2.0.

Coinbase got involved in US elections

A US-based exchange, Coinbase was one of the biggest backers of efforts by the crypto industry to influence the outcome of the 2024 elections. Coinbase and Ripple contributed more than $90 million to the political action committee Fairshake, which purchased media buys to support whom it considered “pro-crypto” candidates in congressional races.

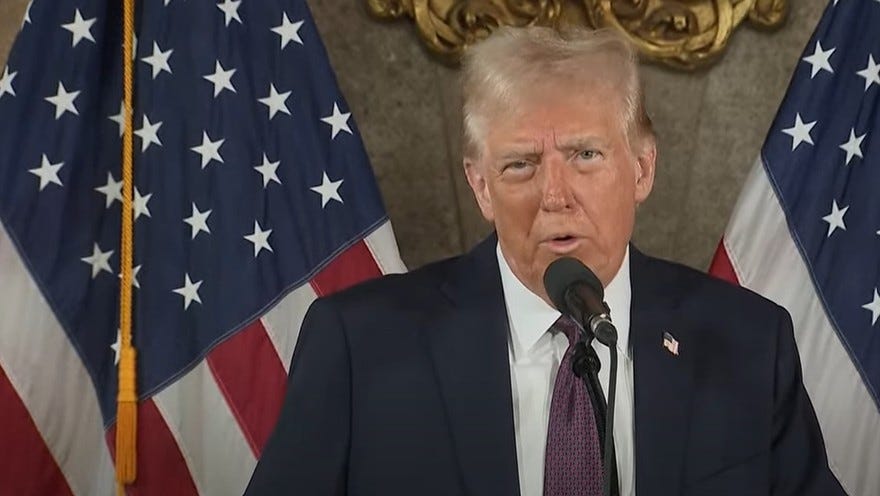

After the presidential election went to Republican Donald Trump, Grewal renewed calls on the SEC to change its approach to digital assets. Gensler announced he intended to step down as chair on Jan. 20, and commissioner Jaime Lizárraga will also depart before Trump’s inauguration, potentially leaving the agency understaffed going into 2025.

Magazine: How crypto laws are changing across the world in 2025