Yesterday was seen as something of a crisis averted for the bond market but the vigilantes are back today. Even a strong 30-year auction with a 2.6 bps stop through was able to only briefly halt the selling.

Yields are now at the highs of the day up 6.9 bps to 4.86%.

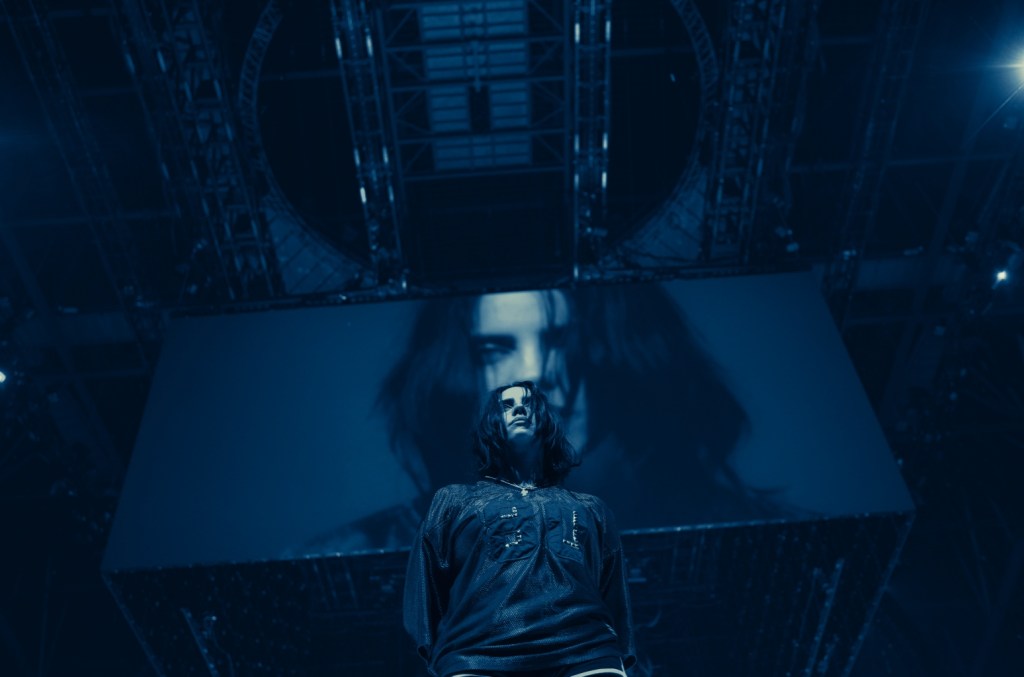

US 30 year three-day chart

Why?

I suspect the budget vote might have something to do with it. Fiscal hawks in the Republican party caved on the vaguest of promises from Senate and House leaders to find savings amounting to $1.5 trillion.

The message is that leadership would rather strong-arm holdouts rather than find real savings. The result is likely to be a budget that further increases the US deficit at a time when it’s already running at 6-7% of GDP (and potentially heading into a recession). At the same time, the largest US trading partners are being harangued for financing that deficit.

Old WSJ Fedwatcher Jon Hilsenrath today writes about rising yields today:

Why? The most obvious reason is that the House today passed a budget agreement that conforms to Senate plans to INCREASE budget deficits from $2 trillion a year to nearly $3 trillion in the years ahead. There’s simply too much darn supply of Treasury debt.

So far the DOGE cuts are cosmetic, and might even worsen the deficit by stripping the Internal Revenue Service of workers and thus enforcement power. The Penn Wharton Budget Model estimates the deficit is up 7.5% so far this year compared to a year earlier.

The deficit isn’t shrinking and Congress doesn’t seem to have a viable plan to address it prospectively.

I still tend to think there are issues around the basis trade and swaps that are problematic and hurting bonds but at some point the long-term deficit problem will become a near-term one.