Alphabet will announce its earnings after the close. Analysts expect Alphabet to report year-over-year growth in both revenue and earnings.

-

FactSet consensus estimates EPS at $2.01, a 6.3% increase from $1.89 a year ago.

-

Revenue is projected at $89.2 billion, up 10.8% from $80.5 billion in the prior year.

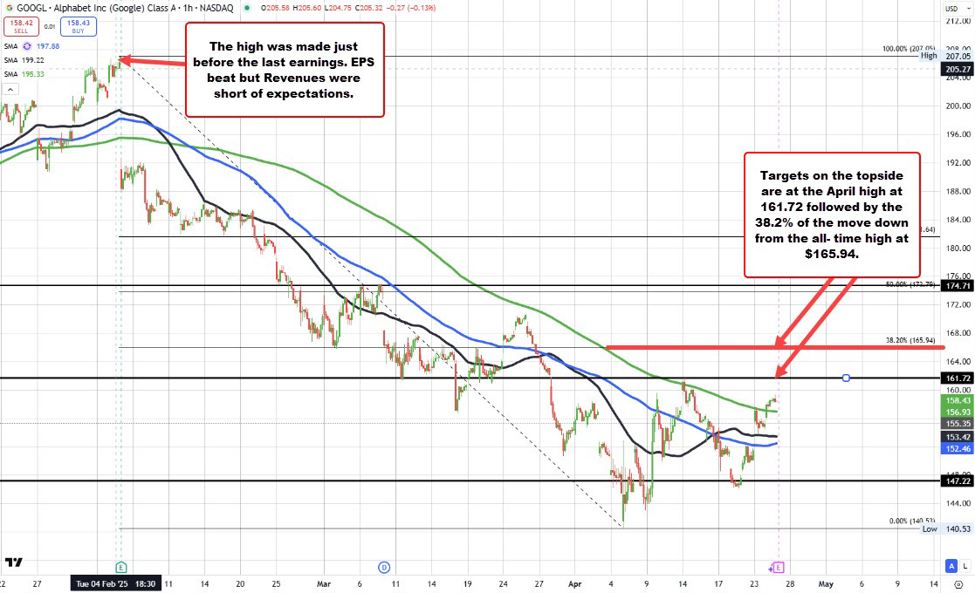

Alphabet’s all-time high was reached on February 4, the day of its last earnings report. At that time, the company posted EPS of $2.15, slightly beating estimates of $2.12. However, revenue came in below expectations at $96.47 billion versus the $96.69 billion consensus. Despite the earnings beat, the stock closed at $206.13 that day and opened sharply lower the following morning at $191.08—a 7.3% drop. The selloff deepened over the following weeks, ultimately bottoming at $140.53 on April 7, marking a steep -32.13% decline from the February high.

Since that low, the technical picture has remained weak, with the stock trading below its 200-hour moving average for much of the time—except for seven isolated hourly bars. However, today marks a potential shift in sentiment. Alphabet’s stock has moved back above its 200-hour moving average, currently at $156.93, and has held above that level for five consecutive hours. As of now, the stock is trading at $158.36, up 1.93% on the day.

Technically, holding above the 200-hour moving average keeps the bullish case alive in the short term. A break below that level—and below the 50-hour moving average at $153.42 and the 100-hour moving average at $152.46—would shift the bias back to the downside.

On the upside, the next key resistance target is the April 14 high at $161.72. Beyond that, the 38.2% retracement of the drop from the February high comes in at $165.94, just above the 50-day moving average at $164.61. A break above both would strengthen the bullish outlook and open the door for further recovery.

Intel will report its earnings after the close, with shares rising $0.80, or 3.91%, to $21.40 today. Analysts are expecting the company to

- Break even on earnings per share ($0.00), with

- Revenue projected at $12.3 billion.

For comparison, Intel posted EPS of $0.18 and revenuesof $12.72 billion in the same quarter a year ago, indicating a decline in both top- and bottom-line performance.

Year-to-date, Intel shares are up 6.74%, having ended 2023 at $20.05. However, this modest rebound follows a challenging 2024, during which the stock plummeted 60.10% as it lost ground to competitors like Nvidia and AMD. The stock hit a low of $17.67 on April 8 and has since rebounded by 21%, but it remains far below previous highs. For context, Intel traded as high as $69.29 in 2020 and closed December 2023 at $51.28.

Despite the recent bounce, Intel’s long-term recovery remains a work in progress, with market share losses and competitive pressures still weighing on its broader outlook.

Intel hired a new CEO Lip-Bu Tan, who is slashing costs (recently announced another 20% reduction in staff), and looking to shore up the balance sheet by selling existing businesses. As such, this quarter may be a “throw out everything but the kitchen sink” cleansing, before the rise from the ashes.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.