Moody’s chief economist Mark Zandi has escalated his warning on the U.S. housing market, shifting from a “yellow flare” to a “red flare” as conditions continue to deteriorate under the weight of high mortgage rates.

In a series of posts on social media platform Twitter, Zandi outlined how persistently elevated mortgage rates—hovering near 7%—are exerting significant pressure on housing demand, homebuilding activity, and price growth. He warns that without a meaningful drop in rates soon, the market is heading for a broader slump.

- “Home sales, homebuilding, and even house prices are set to slump unless mortgage rates decline materially from their current near 7% soon,” Zandi wrote. “That, however, seems unlikely.”

Zandi noted that while overall home sales are already sharply depressed, homebuilders had been using mortgage rate buydowns to keep new home sales afloat. But with buydown costs becoming unsustainable, many builders are now backing away. A clear sign of their caution: delays in land purchases from land banks—a precursor to future construction activity. As a result, Zandi expects new home sales, housing starts, and completions to drop in the coming months.

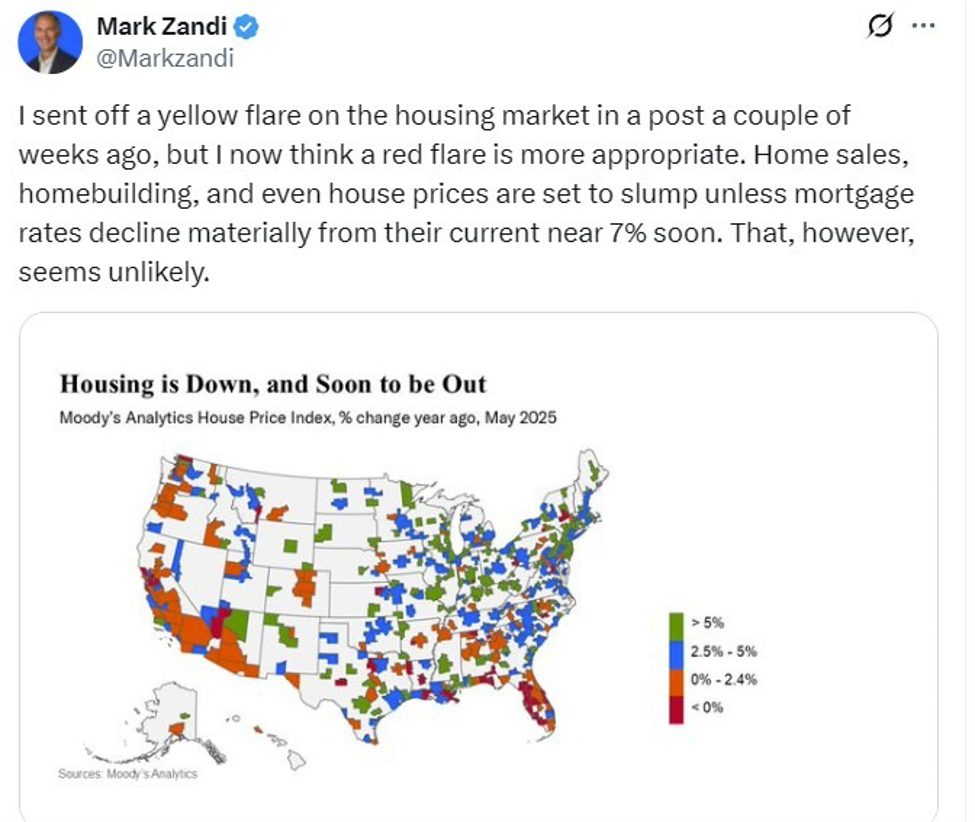

Adding to the gloom, Zandi said that the resilience in house prices is also fading.

- “House price growth had held up well. But this, too, is changing,” he said, noting that prices have flattened and are likely to decline. Rising supply, coupled with affordability challenges and demographic shifts, is weakening the market’s foundations.

- “Locked-in homeowners must move,” he added, referring to owners who secured low-rate mortgages during the pandemic

- “They can only work around these needs for so long.”

Zandi concluded with a broader warning: the housing sector, once a stabilizer in the post-COVID recovery, is now turning into a “full-blown headwind” for the U.S. economy. It joins a growing list of concerns for the outlook into late 2025 and early 2026, raising fresh questions about the trajectory of growth and the Federal Reserve’s path forward.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.