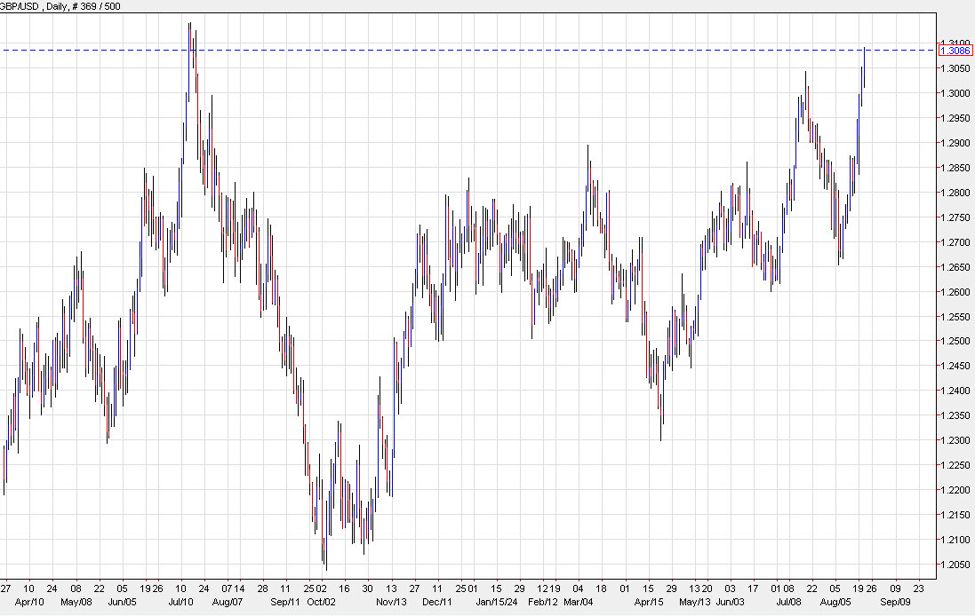

We’re getting the point where we need to really zoom out to paint a picture of the foreign exchange market. A great example is in cable, where the daily chart illustrates that we’re only 60 pips away from the July 2023 high.

GBPUSD daily

If that breaks, then the weekly chart highlights minimal resistance up to the 1.36 zone.

GBPUSD weekly

The pound initially fell after the July 24 election but it’s since recouped all those losses and more. Kier Starmer’s government is off to an uneven start but will offer stability over the next 4-5 years at a time when the US outlook is far less certain and Europe continues to be a mess.

The UK economy isn’t strong by any means but it’s plodding along and the Bank of England has some room to cut rates. The market sees only a 35% chance of a cut at the Sept 19 meeting but is fully priced for a cut in November (26 bps).

The main driver of cable strength lately is the US dollar side as USD broadly weakens as the market senses a long rate-cutting cycle and lower rates. The market may also be sensing a split congress in light of Kamala Harris’ polling gains. That should lead to a much-tighter US fiscal picture and possibly a rise in corporate tax rates.